Patrick Sullivan

Vice President,

MPF Mortgage Analytics,

MPF Program

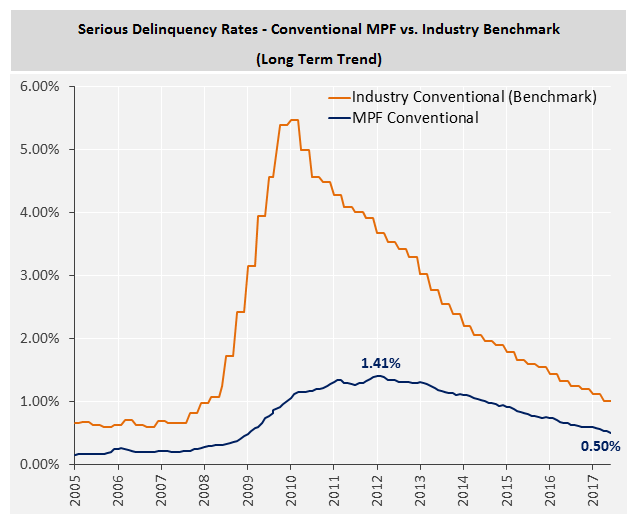

Across the industry, 2017 has marked a pivotal year in which delinquency rates have generally returned to “pre-crisis” levels. This return to relative normalcy reflects the conclusion of a nine-year period of gradual turnaround aided by a steadily improving economic and home-price environment, enhancements in default servicing standards, and the historically high performance of conventional loans originated since 2009. The MPF Program reached a milestone in Q2 2017, with the serious delinquency rate on loans outstanding across all conventional products declining to a nine-year low of 0.50%.

Since the MPF Program was created in 1997, MPF loans have consistently outperformed industry benchmarks. As illustrated in the graph below, while MPF loans inevitably experienced an increase in delinquencies and defaults in the wake of the severe economic event of 2008-2009, their performance was strikingly different from that seen in the broader industry. While the serious delinquency rate for conventional loans exceeded 5.00% at its highest point across the broader industry, it peaked at just 1.41% within the MPF Program, reflecting a gradual increase rather than a drastic spike. The superior performance of MPF loans prior to, during, and following the crisis years speaks to the high credit quality of loans originated by local and community financial institutions, the core customers of the MPF Program.

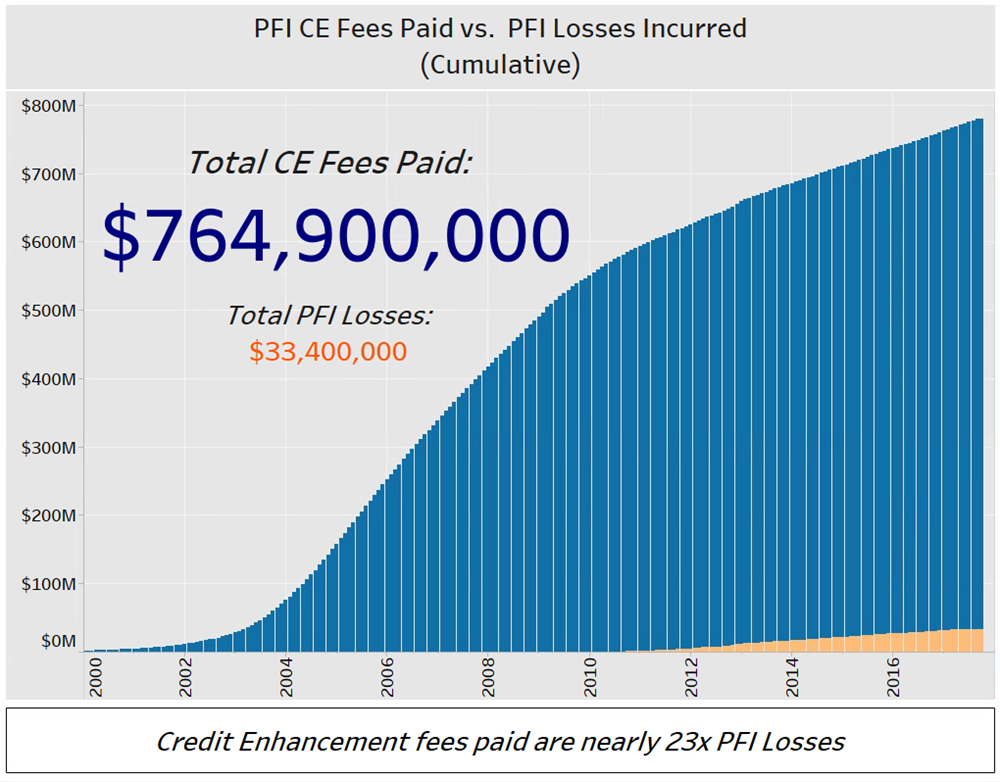

This strong performance over the past 20 years has been advantageous for Participating Financial Institutions (PFIs) delivering conventional loans under the MPF risk-sharing products. Through August 2017, PFI sellers have been paid a total of $764.9 million in credit enhancement (CE) fees for retaining a portion of credit risk, and have incurred a total of just $33.4 million in credit losses associated with the risk-sharing arrangement (a ratio of nearly 23:1, as illustrated in the graph below).  Consistent with the broader industry, performance on loans funded since 2009 has been optimal. Going forward, we expect the ratio of CE fees paid to PFI credit losses incurred to increase, further rewarding PFIs for delivering high-credit-quality loans with performance that rivals the best in the industry.

|