|

Dear Agent,

TWIA has implemented a change to premium refunds on policies cancelled by the policyholder, in compliance with House Bill 3208 passed earlier this year. This change applies to policies effective 9/1/23 and after.

Policies effective before 9/1/23: When a policy is cancelled by the policyholder, TWIA retains minimum earned premium of at least 90 days of the annual policy term or $100.

Policies effective 9/1/23 and after: When a policy is cancelled by the policyholder, TWIA retains the entire annual premium, unless the policy was cancelled for one of the following reasons:

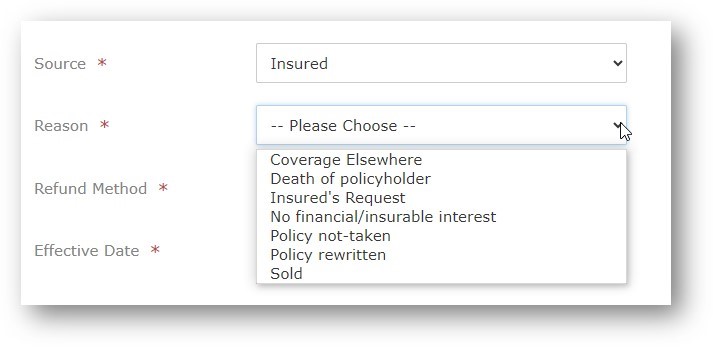

- The purchase of similar coverage in the private market (“Coverage Elsewhere” in Portal dropdown)

- The death of the policyholder (“Death of policyholder” in Portal dropdown)

- The total loss of the property (“No financial/insurable interest” in Portal dropdown)

- The sale of the insured property (“Sold” in Portal dropdown)

The coverage will end at the date of cancellation even when a policy cancelled by a policyholder does not allow a refund.

This change to premium refunds on policies cancelled by the policyholder:

- Requires the policyholder to provide proof of the cancellation reason in order to get a refund.

- Does not apply to policies cancelled by TWIA. If a policy cancellation is initiated by TWIA, the premium refund will be pro-rata.

- Does not change the way a policy cancellation is submitted. Policy cancellations should be requested in the TWIA Agent Portal.

If you have any questions or concerns, contact us at agentservices@twia.org or (800) 788-8247. Our normal business hours are Monday-Friday, 8:00 a.m.-5:00 p.m.

Sincerely,

Texas Windstorm Insurance Association

|