Greetings:

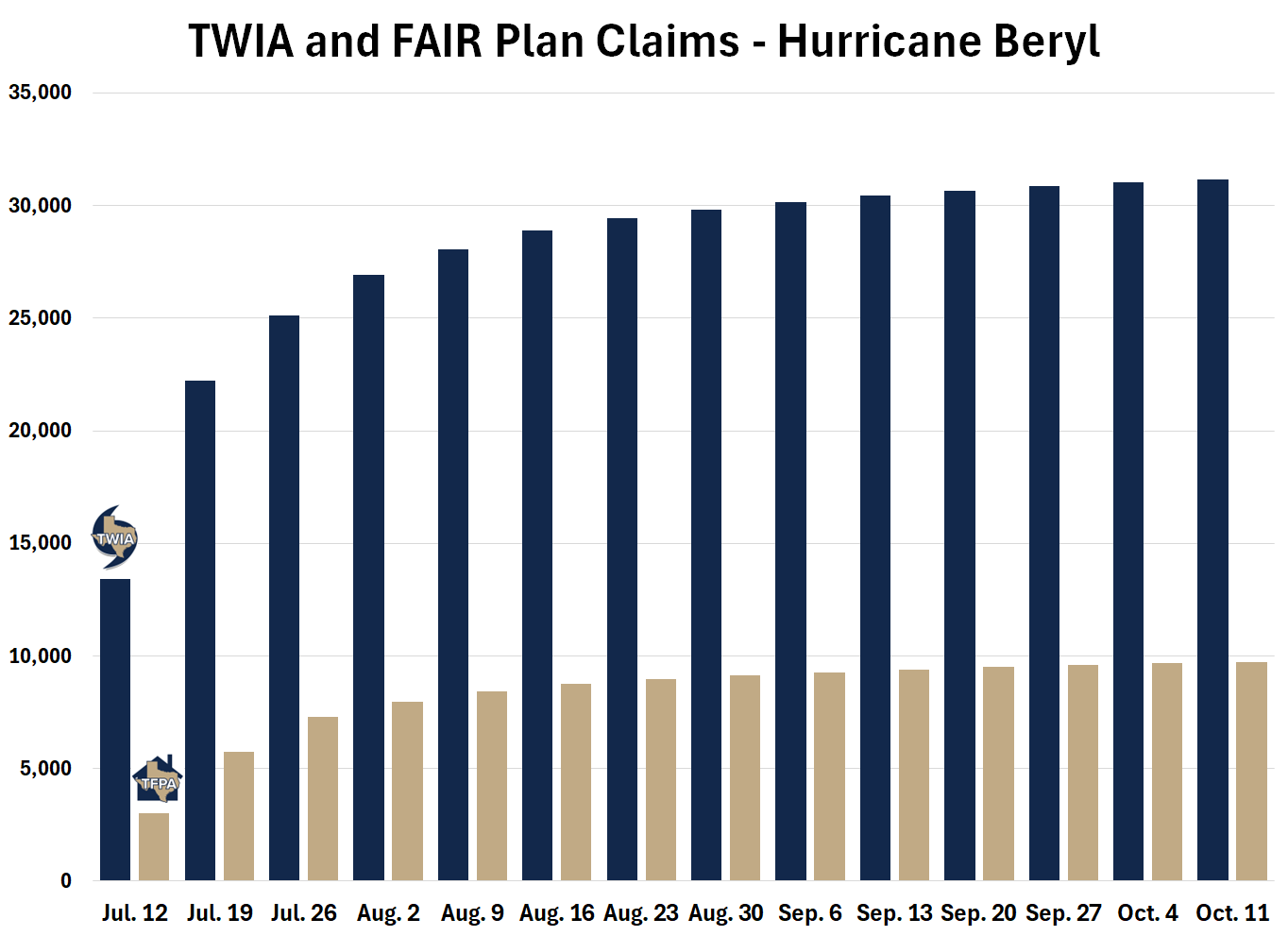

The Texas Windstorm Insurance Association and Texas FAIR Plan continue to receive claims from Hurricane Beryl at a slower rate. As of October 11, we have received 31,163 TWIA claims and 9,740

FAIR Plan claims. To date, we have paid $258.7 million on TWIA claims and $72.9 million on FAIR Plan claims. For TWIA, nearly 73% of claims have been closed or are open with a payment already made to the policyholder; for FAIR Plan this figure is 93%.

Additional resources for policyholders are available on the Association websites: TWIA.org and TexasFAIRPlan.org.

Hurricane Milton

TWIA implemented a moratorium on new or increased policies due to Hurricane Milton’s presence in the Gulf of Mexico last week. FAIR Plan also implemented a moratorium in the 14 (TWIA) coastal counties and Harris County. The moratoriums were in place from 1:00 p.m. on Sunday, October 6 through 12:01 a.m. on Monday, October 7. This storm did not have any impact on Texas.

Maximum Liability Limits

Earlier this week, the Texas Department of Insurance issued a final order on TWIA’s annual filing on maximum limits of liability for 2025 windstorm policies. These limits specify the maximum amount for which TWIA may insure a property. TDI accepted TWIA’s proposed increase in liability limits for manufactured homes and ordered that residential, condominium, and commercial limits remain unchanged. The limits effective January 1, 2025 will be:

- Dwellings and individually-owned townhouses: $1,773,000

- Contents of an apartment, condominium, or townhouse: $374,000

- Manufactured homes: $116,700

- Commercial structures and associated contents: $4,424,000

Should you have any questions, please contact me at DDurden@twia.org.or (512) 505-2255.

Sincerely,

David Durden

General Manager

Texas Windstorm Insurance Association

|