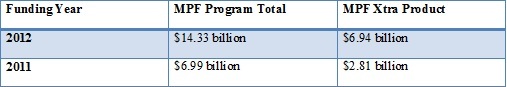

The Mortgage Partnership Finance® Program saw a dramatic increase in participation in 2012 as community lenders sought to compete with larger banks in the mortgage lending market, maintain customer relationships, and minimize risk. The number of participating community lending institutions grew 15% over the previous year to a total of nearly 800, but the most striking increase was in loan volume: Member institutions funded $14.33 billion in loans in 2012 – more than double the volume seen in 2011 – using the MPF Program. Of that volume, almost $7 billion was in the MPF Xtra® product, through which the loans are concurrently sold to Fannie Mae.

By aggregating home loans, the MPF Program allows small and mid-sized lenders across the country to provide mortgages that would otherwise be available only from larger banks, while retaining the option to service the loans locally.

“Our continued focus on customer service has definitely contributed to the popularity of this program product,” said Eric Schambow, Senior Vice President and Director of the MPF Program. “The MPF Program lets community lenders offer their customers home loans at a competitive price, which means borrowers can continue to work with their local lending institutions they know and trust, and Federal Home Loan Bank (FHLB) Members can take advantage of their existing relationship with their FHLB.”

One benefit of this relationship is the high level of support FHLB Members receive when they use the products, including customized onsite technical training, a toll-free product-expert hotline, complimentary monthly webinars, and access to Fannie Mae’s Desktop Underwriter®, an automated credit risk assessment tool.

|